11: Deep dive into the Defense Sector in India with Avnish Patnaik, ex-deputy director and lead at Society of Indian Defence Manufacturers (SIDM)

What are the challenges of the defence sector in India? How can foreign companies invest in this industry? What are the governement regulations? This and more in today's newsletter!

📝 Words: 1,852 | 🕰️ Estimated Reading time: about 8 mins

Hi Kula readers,

In this week’s newsletter, we had the pleasure of interviewing a young professional making waves in India's defense sector, Avnish Patnaik was the past deputy director and lead at Society of Indian Defence Manufacturers (SIDM).

In our discussion, we explored the defense sector in India, delving into the role that the SIDM plays in its development, as well as India's position in the international defense landscape.

If you are curious about the defense sector in India or you would like to understand more about India's international position in this industry read the article till the end and discover more!

Key Takeaways

🇮🇳 Transformation of India's Defense Sector: India has shifted from dependency on imports to emphasizing self-reliance and indigenous manufacturing. Liberalization policies and initiatives like "Make in India" and Defense Procurement Procedure (DPP) 2016 have fueled growth and innovation in the sector. India's defense budget for 2024 stands at approximately $70 billion, ranking third globally.

🤝 Government Initiatives Driving Indigenous Manufacturing: Initiatives such as "Make in India" and DPP 2016 aim to streamline defense procurements, promote ease of doing business, and boost indigenous manufacturing through policy reforms and increased FDI caps. Defence exports have surged from Rs 1,521 crore in 2016-17 to Rs 21,083 crore in 2023-24, marking an 8.7 times increase.

💶 FDI Policy Relaxations: The relaxation of FDI norms reflects the government's commitment to attracting foreign investment and fostering indigenous capabilities in defense manufacturing. Various routes incentivize foreign OEMs to invest in India's defense sector. The FDI cap in defense production has been raised to 74%, and up to 100% FDI is permitted with government approval.

🪃 Challenges and Stakeholder Dynamics: Challenges faced by stakeholders like the defense public sector, armed services, and ministries hinder the pace of indigenization efforts. Addressing these challenges is crucial for achieving self-reliance in defense production. Most recently approved defense acquisition proposals, totaling Rs 2.23 trillion, were sourced from domestic suppliers in 2023.

Avnish Patnaik - Past Deputy Director and Lead at SIDM

Avnish holds a BA (Hons) in History from Sri Venkateswara College, University of Delhi, and an MSc in International Business from IESEG School of Management in Paris, France. He spearheaded SIDM’s International initiatives, engaging with domestic and international stakeholders to shape India’s Defence Industrial priorities.

Avnish assists member companies in identifying international markets and strategic partners, facilitating their global expansion. With extensive experience managing programs across 25 countries, he has led 8 International Industry Delegations to key nations. He was Secretary of SIDM’s International and Export Committee, representing over 40 Indian companies engaged in Export and International business. Recently, he participated in the French Ministry of Defence’s Future Leaders Programme in 2023, an exclusive initiative hosting 30 young leaders annually in France.

What is SIDM - Society of Indian Defence Manufacturers ?

The Society of Indian Defence Manufacturers (SIDM) is not-for-profit association formed to be the apex body of the Indian defence industry. SIDM plays a proactive role as an advocate, catalyst, and facilitator for the growth and capability building of the defence industry in India.

The Society represents the entire spectrum of Defence and Aerospace manufacturers in India covering both the Public and the Private Sector. Its membership constitutes Large companies, MSMEs, Start-Ups, FOEMs and Academic Institutions which are spread across all states and regions of the country.

In 2022, SIDM celebrated it’s 5th anniversary along with a milestone of crossing 500 members. SIDM has emerged as the single reference point for countries looking to engage with the Indian Industry, having organised numerous bilateral interactions to strengthen India’s defence industrial ties and signed MoUs with industry associations of France, UK, Sweden, South Korea, Brazil & Australia. SIDM is committed towards making India Aatamanirbhar in Defence Production and is “Proud to Arm the Nation”.

💡 Read more about SIDM history herehttps://www.sidm.in/about-us

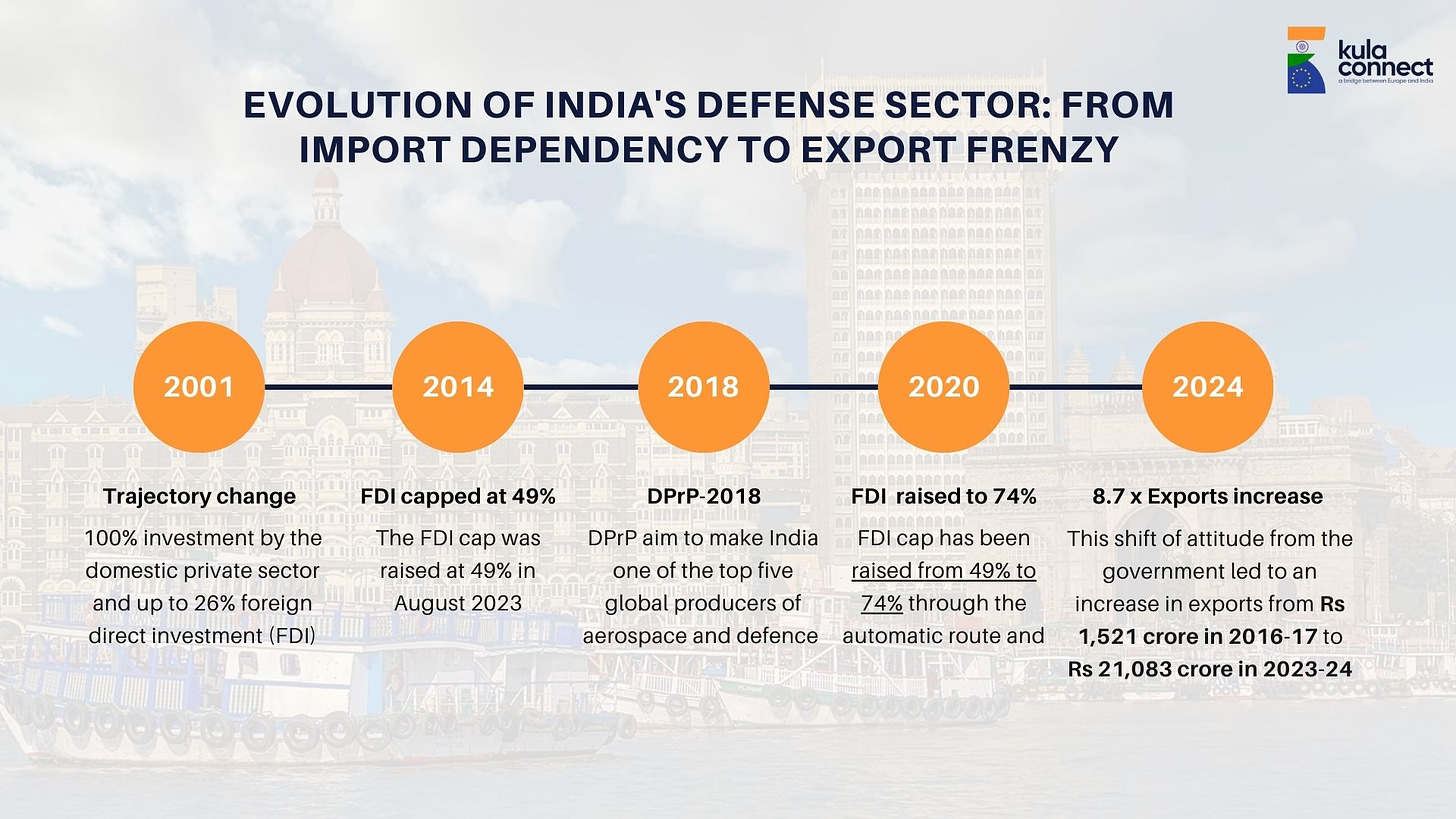

Evolution of India's Defense Sector: From Import Dependency to Export frenzy

India has one of the world's biggest military forces, comprising over 1.44 million active personnel and a defense budget of about $70 billion for 2024, ranking third globally after the USA and China.

The Indian Defense Sector has experienced a notable evolution in recent years, shifting from being a major importer to emphasizing domestic production and exports (INR 210.83 Crore or $2.5Billion in fiscal year 2023-2024) with the number of export authorizations steadily growing.

Until the turn of the century, India’s defense sector had been exclusively reserved for the government and Defence Public Sector Undertakings (DPSUs). Traditionally, India has heavily depended on imports, covering around 60-65% of its defense needs. However, with increasing import costs and concerns regarding national security, the government has shifted its focus to self-sufficiency and local production in defense.

2001: The ‘defense industry’ sector is opened up for full participation

In May 2001, the government liberalized the manufacture of defense equipment in India, allowing 100% investment by the domestic private sector and up to 26% foreign direct investment (FDI) with approval from the Foreign Investment Promotion Board (FIPB) and subject to the Indian company obtaining an industrial license from the Department of Industrial Policy and Promotion (DIPP).

2014: FDI Policy Reforms in sectors listed under Make in India, FDI capped at 49%

The government has introduced the "Make in India" initiative to encourage domestic manufacturing, including in the defense sector. The FDI cap was raised to 49% in August 2014.

2018: Defence Production Policy of 2018 (DPrP-2018)

Policies like the Defence Production Policy of 2018 (DPrP-2018) aim to make India one of the top five global producers of aerospace and defense equipment, with an annual export target of $5 billion by 2025.

2020: FDI limit in Defence Production raised to 74%

The Foreign Direct Investment (FDI) cap in the defense sector has been raised from 49% to 74% through the automatic route and up to 100% with government approval.

Private Investment Drives Surge in India's Defense Exports

Private entities like Larsen & Toubro, Tata Group, Mahindra Group, and Adani Group have made substantial investments in defense manufacturing. The sector has witnessed the entry of over 300 new private companies, including MSMEs, signaling a departure from the previous dominance of public sector units (PSUs).

This shift of attitude from the government has led to an increase in defense exports from Rs 1,521 crore in 2016-17 to a staggering Rs 21,083 crore in 2023-24, marking an 8.7 times increase.

Make in India: Elevating India's Defense Sector on the Global Stage

Since the launch of the "Make in India" initiative by the Government, the defense sector has experienced significant growth, attracting both Indian private industry and foreign OEMs (Original Equipment Manufacturers). Under the leadership of the Hon’ble Raksha Mantri, critical changes have been implemented to streamline defense procurements and encourage ease of doing business.

With over USD 250 Bn worth of procurement over the next 10 years, the Defence Sector is expected to lead the Make in India initiative of the Government.

The introduction of the Defence Procurement Procedure (DPP) 2016 has facilitated co-development and co-production approaches between foreign OEMs and Indian partners. India's defense spending is on the rise (7-8% year over year), presenting substantial opportunities for domestic and global companies. These initiatives aim to bolster domestic manufacturing and encourage participation from Micro, Small, and Medium Enterprises (MSMEs).

With major deals signed with countries like France, the US, Russia, and Israel, India's stature as a responsible global power in defense is on the rise.

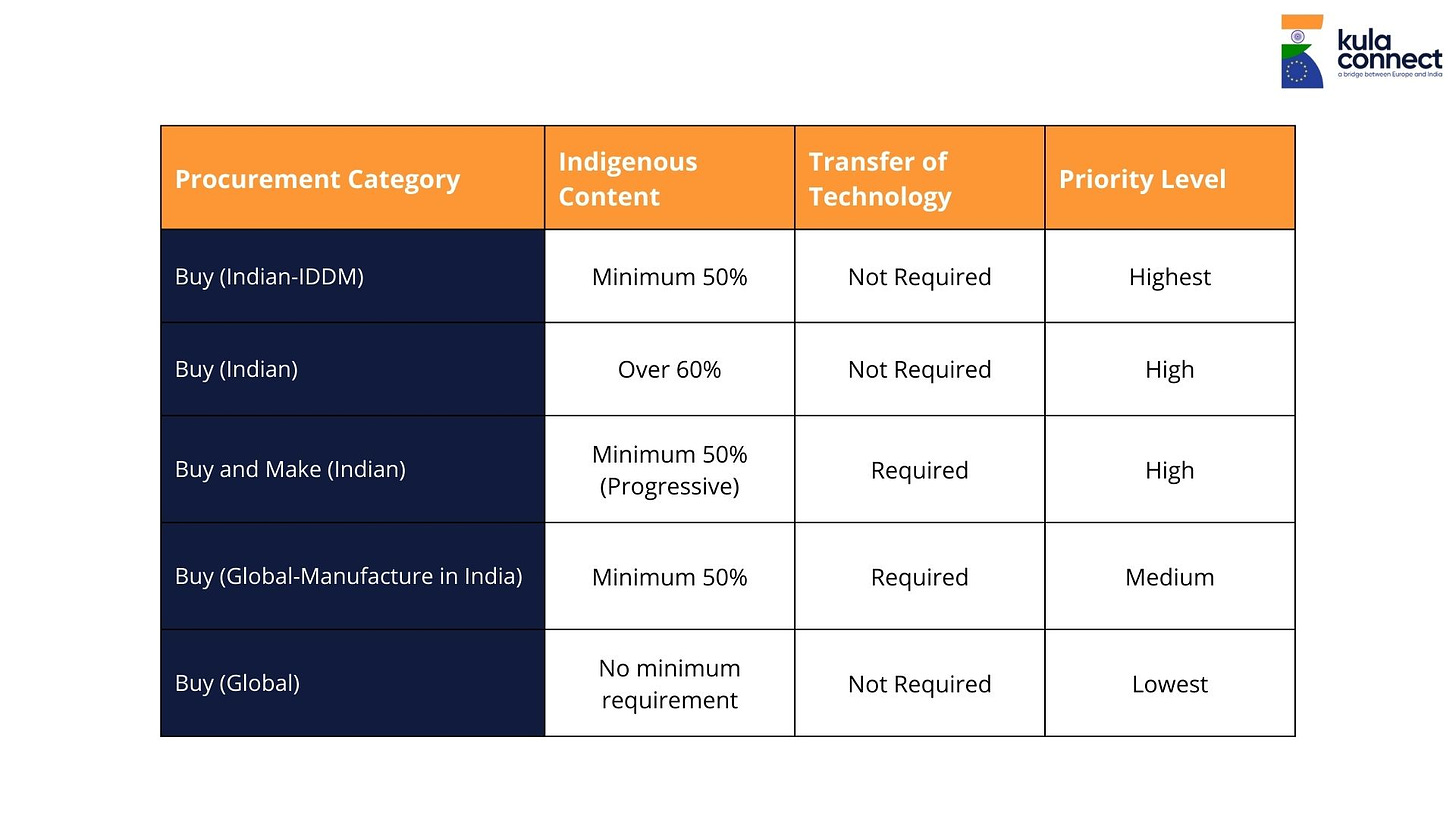

Promoting local procurement - The Defense Acquisition Procedure

India's drive for self-sufficiency in defense is gaining momentum with a fresh outlook on transparency and openness.

The introduction of the Defence Acquisition Procedure (DAP 2020) in 2020 signifies a pivotal shift.

The DAP mandates that all defense modernization needs must be met domestically, with imports granted only under exceptional circumstances approved by the Defence Acquisition Council (DAC) or Defence Minister.

The DAP ensures the acquisition of top-notch military gear, prioritizing performance and quality. It's not just about buying; it's about nurturing homegrown talent.

The DAP has provisions under the 'Make in India' initiative, like increasing the automatic FDI cap in defense to 74%, refining procedures to empower MSMEs, and distributing orders among vendors.

Foreign companies, registered in India with up to 74% ownership, are accorded the privileges and benefits reserved for domestic enterprises.

The Ministry of Defence has notified three 'Positive Indigenization Lists' comprising 411 defense equipment that must be manufactured locally, promoting self-reliance. These lists cover weapons, sensors, ammunition, auxiliary equipment, and other items across the Army, Navy, and Air Force.

Here's a table summarizing the key procurement categories under the Defence Acquisition Procedure (DAP) 2020 and their characteristics:

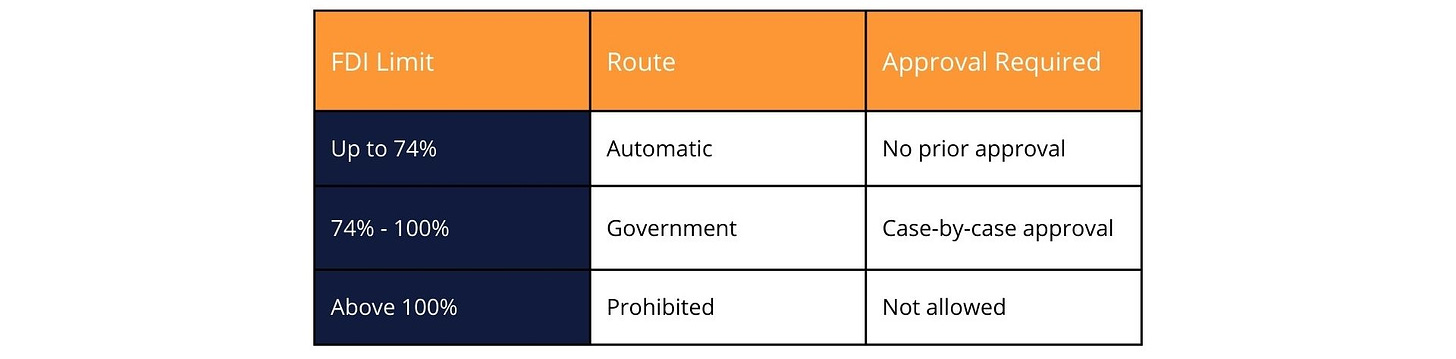

Promote local production while fostering foreign investments

The government's commitment to bolstering indigenous procurement in the defense sector is evident, with a staggering 98% of recently approved defense acquisition proposals, totaling Rs2.23trn ($26.8bn), sourced from domestic suppliers in 2023.

In line with the objective of promoting self-reliance, the Foreign Direct Investment (FDI) policy allows for up to 100% foreign investment in defense manufacturing, facilitated through various routes. Despite this relaxation, investments beyond 74% still necessitate government approval on a case-by-case basis, ensuring careful scrutiny, particularly concerning national security, by the Ministries of Defence and Home Affairs.

The rationale behind these relaxed FDI norms is to attract foreign original equipment manufacturers (OEMs) and their advanced technology, thereby fostering the growth of indigenous defence manufacturing capabilities within the country.

Here's a table summarizing the FDI policy framework for the Indian defence sector:

To discover how the different routes work, check out the government website https://www.makeinindia.com/policy/foreign-direct-investment

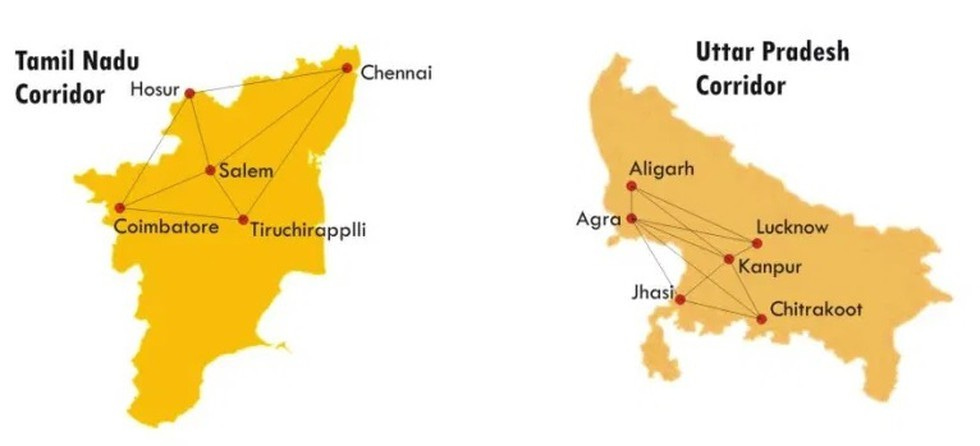

Defence Industrial Corridors

India's Defence Industrial Corridors, established in Uttar Pradesh and Tamil Nadu, are pivotal initiatives aimed at enhancing the nation's domestic defense manufacturing capabilities. These corridors seek to attract investments from domestic and foreign companies by leveraging existing ecosystems and infrastructure.

The Uttar Pradesh Defence Industrial Corridor (UPDIC), launched in 2018, spans six nodes across five districts, including Agra, Aligarh, Lucknow, Kanpur, Jhansi, and Chitrakoot. It aims to draw investments totaling Rs 20,000 crore, generating 2.5 lakh jobs, with a focus on aerospace, armaments, and accessories.

The Tamil Nadu Defence Industrial Corridor (TNDIC), introduced in 2019, encompasses five nodes in Chennai, Coimbatore, Salem, Tiruchirappalli, and Hosur. It anticipates investments of Rs 3,123 crore, creating 16,000 job opportunities, and emphasizing aerospace components and armored vehicles.

These corridors are part of the "Make in India" initiative, aiming to enhance self-reliance in defense production. They foster collaboration between public, private, and foreign entities, promote technology transfer, and support skill development in the defense sector.

Conclusion: Navigating Growth in the Defence Sector

Situated at the crossroads of geopolitical tensions, particularly in the context of China's ambitious Belt and Road Initiative, India's defense sector assumes vital importance.

With the Make in India initiative, India is pushing for the nationalization of the defense sector. However, thanks to the opening towards foreign direct investment, the defense market can also be accessed by foreign companies that must produce in India or have a significant part of their production in India.

In this journey towards self-sufficiency (Atmanirbhar Bharat), building capabilities and seizing growth opportunities demand patience, perseverance, and a steadfast commitment to excellence. The establishment of defense industrial corridors, increased capital allocation for domestic procurement, and a thrust on public-private partnerships have set the stage for a robust and self-sustaining defense ecosystem.

However, the road ahead is not without challenges. Bridging the technological gap, fostering innovation, and nurturing a vibrant private sector will be crucial. As India aspires to become a leading defense exporter, the focus must remain on developing cutting-edge capabilities, nurturing a skilled workforce, and fostering international collaborations

What is your thought on India’s position to internalize the production for the defense sector?

Let us know in the comments

Sources:

LinkedIn Article: This LinkedIn article discusses the growing defense and aerospace industry in India, driven by the government's 'Aatmanirbhar Bharat' (self-reliant India) initiative. It highlights the projected growth rate of 10.6% for the industry from 2021 to 2028.

Economic Times Article: This article from the Economic Times mentions that India's defense sector has opportunities worth USD 138 billion over the next 10 years, driven by the government's focus on indigenization and self-reliance.

Invest India: This is the official website of Invest India, providing information on investment opportunities in India's defense manufacturing sector. It highlights the government's initiatives, such as the establishment of defense industrial corridors and schemes like iDEX and DTIS.

McKinsey Report: This report by McKinsey & Company provides insights into the aerospace and defense industry, including trends and opportunities in India.

CII Resource: This resource from the Confederation of Indian Industry (CII) discusses the potential of India's defense industry and the opportunities for growth.

CII Blog Article: This blog article from CII highlights India's growing importance in the global defense sector, driven by initiatives like 'Make in India' and 'Aatmanirbhar Bharat'.

CII Defence: This is the official website of the CII Defence Division, providing information on the organization's activities and initiatives related to the defense sector in India.

Indian Defence Review Article: This article from the Indian Defence Review discusses the growth path of India's defense industry, highlighting the government's efforts towards self-reliance and indigenization.

IISS Article: This article from the International Institute for Strategic Studies (IISS) discusses India's defense industrial partnership with the UK, emphasizing the requirement for defense projects to be Indian-owned and controlled.