21: Strategic Insights and a Case Study on Business Expansion in India with Adriano Ceci Neva from Relations at Work (RAW)

How can companies successfully expand their business in the Indian market? What strategies work best? Insights RAW, a strategic consulting group, featuring a detailed case study of NTK Europe.

📝 Words: 2562 | 🕰️ Estimated Reading time: about 10 mins

Hey Kula readers,

This week, we spoke with Adriano Ceci Neva from Relations at Work (RAW), a group of companies operating in Consulting, Finance, Logistics and Trading with a team of Italian and International managers with extensive experience in the Indian and Bangladesh markets.

They partner with clients to help them navigate the complexity of the Indian market, develop business initiatives, identify investment opportunities and manage current activities.

Today, Adriano from the RAW Advisory team will share strategic insights on expanding business in India. We will also delve into a case study on NTK, a leading manufacturer of high-precision components for the hydraulic sector. RAW Advisory played a key role in helping NTK set up their facilities in India, and we'll uncover the details of this successful collaboration in the article.

Key Takeaways

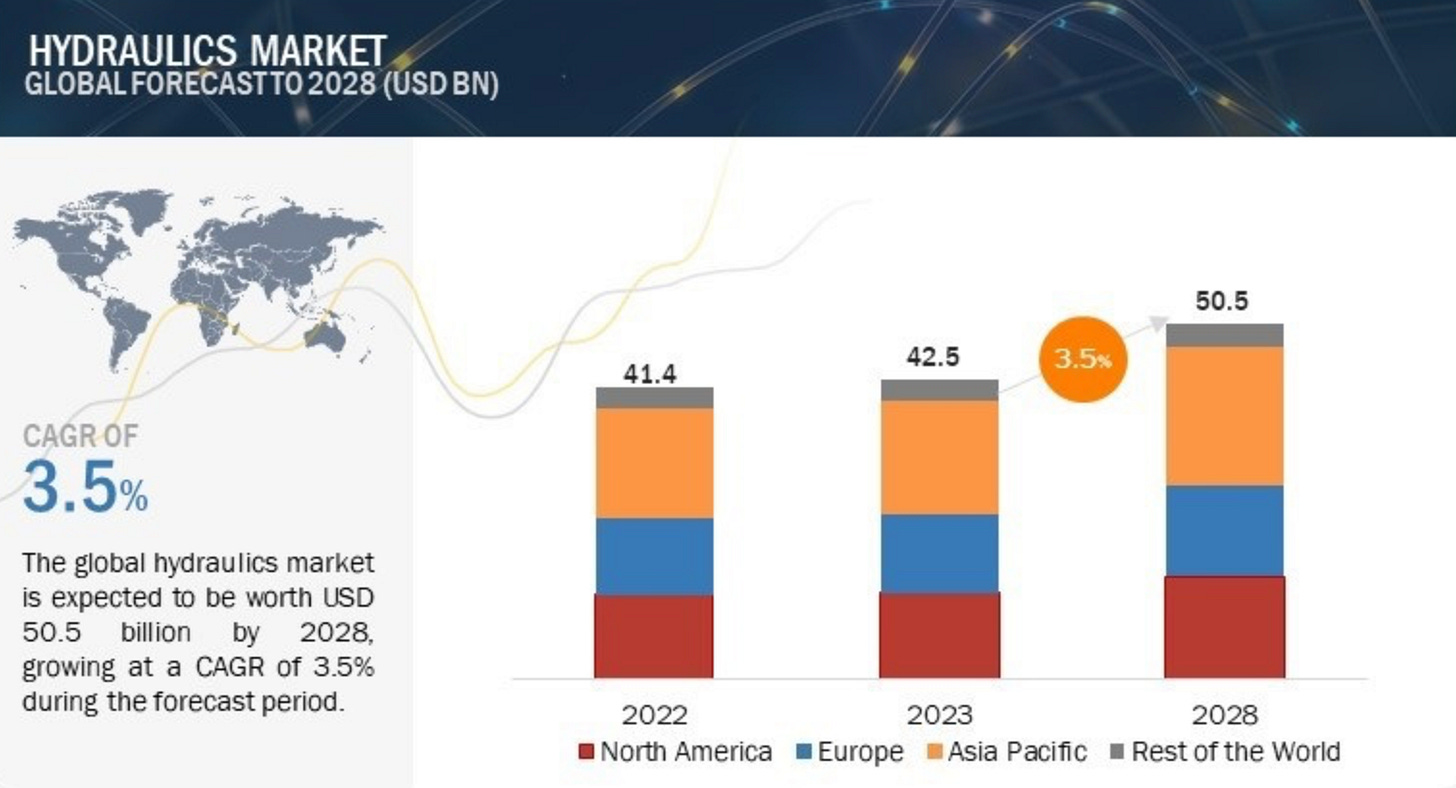

🌟📈 Hydraulics Components Market Growth in India: The hydraulics components sector in India is growing rapidly, outpacing the global market with a CAGR of 6.2% compared to 3.5% globally. This growth is driven by infrastructure development, agricultural expansion, a booming automotive industry, and technological advancements. Significant investments in machinery and safety measures are crucial to leverage these opportunities.

🏭💸 Importance of Local Production to Lower Costs: Local manufacturing in India is essential due to the market's price sensitivity. It helps avoid import duties and high transportation costs, ensuring competitive pricing. Short supply chains enhance efficiency and reduce expenses. Local production also enables quicker adaptation to market demands and regulatory compliance, making it a strategic approach to maintain cost efficiency.

🤝📅 Alignment on Long-Term Goals with Indian Partners: Successful expansion in India requires strong alignment with local partners on long-term goals. Clear alignment of goals and expectations is crucial. Partners must share the vision for growth and understand the mandate. Building trust through open communication and significant financial investments is essential, as shown by NTK's journey in the Indian market.

Adriano Ceci Neva: an Italian who bet on India from the start

Adriano Ceci Neva is a Business Manager at RAW, where he leads various projects to ensure smooth and timely business operations for clients. He acts as the Italian representative in the Indian team, connecting client needs with local support.

Adriano completed his Master's degree in Marketing Management at Luiss University in Rome in 2019. Before joining RAW, he worked for a year at the Italian Chamber of Commerce and Industry (IICCI) in Mumbai, initially as intern and then as a project manager. He joined RAW Advisory in 2019 and became Director of RAW Trading in 2022.

His professional career began directly in India in 2018, accumulating 6 years of experience in the Indian market. Adriano has bet on the potential of the Asian giant from the very start, right after graduating.

In his current role at RAW Adriano offers specialised consulting services to international companies across various sectors—such as automotive, cosmetics, IT, education, industrial machinery, and FMCG—seeking to establish or expand their operations in the Indian market.

CASE STUDY: NTK EUROPE’S HYDRAULIC COMPONENTS MANUFACTURER’S BUSINESS EXPANSION IN INDIA

NTK Europe, a Brescia-based company specialising in hydraulic components manufacturing, faced a strategic challenge with their suppliers in India. These suppliers, although capable in terms of quality, struggled financially and lacked the necessary machinery to scale production efficiently. The complexity and high cost of the required equipment exacerbated these issues, posing a risk to NTK’s supply chain stability.

Industry Overview

The hydraulics components industry, a critical segment of industrial equipment manufacturing, is characterised by its application in diverse sectors such as construction, agriculture, mining, oil and gas, automotive, and aerospace. This industry's growth is driven by the increasing demand for efficient machinery and equipment used in these sectors, which rely on hydraulic systems for power transmission and control. Hydraulic systems are essential due to their ability to handle high-power tasks with precision and efficiency, leveraging the force generated by liquid pressure to perform various mechanical functions like lifting, rotating, and pushing.

Key players in the market include companies like Bosch Rexroth AG, Parker-Hannifin Corporation, SMC, Eaton Corporation, and Caterpillar Inc., which invest heavily in R&D to innovate and improve hydraulic technologies. The global market is expected to grow steadily from USD 42.5 billion in 2023 to USD 50.5 billion by 2028, at a CAGR of 3.5% [Markets and Markets], with significant contributions from regions like Asia-Pacific and North America, driven by industrialisation, infrastructure development, and advancements in hydraulic technology.

The hydraulics components sector is capital-intensive, requiring substantial investments in advanced machinery and specialised facilities. Precision manufacturing in this industry necessitates strict safety standards and controlled temperature environments. High-temperature operations are common, demanding efficient cooling systems and robust safety protocols to protect equipment and personnel. Overheating can degrade hydraulic fluids and damage components, making temperature control vital.

Market Trends: Hydraulics Components in India

As we have seen, the growth of the global market is driven by the Asia Pacific region. India, in fact, is growing and will continue to grow much faster than the global CAGR.

A report by Global Research Consulting states that the Indian hydraulic equipment market is estimated to grow at a CAGR of 6.2%. This magnitude is also confirmed by Customer Market Insight's research, which projects the market to grow from USD 3.05 Billion in 2023 to USD 4.95 Billion in 2032, with a CAGR of 6%.

Therefore, the Indian hydraulics components market is growing at almost double the global rate.

But why is it growing so much?

Infrastructure Development 🏗️

The country is witnessing substantial investments in infrastructure development, including roads, railways, airports, and smart cities. These projects necessitate hydraulic systems and equipment, increasing the demand for hydraulic tubes. Government initiatives like "Make in India" further stimulate market growth.

Agricultural Sector Expansion 🌾

India’s agriculture sector, a significant contributor to the economy, extensively uses hydraulic systems and machinery. The need for efficient irrigation, mechanized farming, and various agricultural equipment drives the demand for hydraulic tubes in the agricultural sector.

Growing Automotive Industry 🚗

The automotive industry in India is experiencing robust growth due to increasing disposable incomes, urbanisation, and favourable government policies. Hydraulic hoses are widely used in automobiles for power steering, braking systems, and hydraulic suspension systems, which creates substantial market demand.

Machinery and Equipment Manufacturing 🏭

The rising demand for machinery and equipment in sectors such as construction, mining, material handling, and agriculture leads to increased production of hydraulic systems. Hydraulic tubes play a critical role in these systems, driving their demand in the manufacturing sector.

Technological Advancements 🔧

Continuous technological advancements in hydraulic hose materials, designs, and manufacturing processes enhance their performance and durability. Indian manufacturers are developing advanced hydraulic hoses with high pressure resistance, flexibility, and temperature tolerance to meet evolving industry needs.

Focus on Quality and Safety ✅

With a growing emphasis on quality, safety, and compliance with international standards, there is increasing demand for high-quality hydraulic tubes that offer reliability and long-term performance. Indian manufacturers are adopting stringent quality control measures to meet these requirements, contributing to the market’s growth.

BACK TO NTK

As we saw in the industry overview, in the hydraulics components sector, what is crucial is:

💸 Significant capital investment, especially for high-precision machinery.

🛡️ Stringent safety measures and protocols.

🔍 Extreme attention to production quality.

Additionally, we have seen the significant opportunities to capture sector growth. For NTK, it was crucial to address the issue related to its Indian partner, which appeared to be misaligned on investments in machinery—a major problem given the capital-intensive nature of the sector.

RAW’s Solution to NTK Problem

RAW’s solution to NTK’s problem was both strategic and innovative, addressing the financial constraints faced by the Indian suppliers while maintaining high quality standards.

Step 1: Production Consolidation & Quality Control

The client, who had been sourcing from India for years, was aware of the limited capital of the various suppliers for the purchase of the machinery required for manufacturing top-notch hydraulic components. Hence, RAW advised the leasing of the machinery to the suppliers as a model. NTK established a local entity to fund the purchase of the machineries, which were leased to the suppliers at a favourable rate, enabling them to access advanced equipment without a substantial upfront investment

Additionally, RAW facilitated the construction of a dedicated production facility within the supplier’s existing plant. This facility was exclusively focused on producing NTK’s components, ensuring stringent quality control and efficient production processes. This dual approach ensured stringent quality control and streamlined production processes, ultimately resolving immediate financial and operational hurdles and enhancing NTK’s supply chain by aligning the supplier's capabilities with NTK’s exacting standards.

Step 2: Business Expansion

Following the successful implementation of this solution, the NTK experienced significant improvements in production efficiency and quality. Over the next three years, the collaboration with the Indian supplier flourished, prompting NTK to further solidify their presence in the Indian market. In August 2022 the Client and the supplier established a joint venture, with a 78%-22% split in favour of NTK. This partnership facilitated deeper integration and control over the production process.

However, due to differences in long-term vision and targets, it was decided, in agreement with the partners, to take full control of the facility by April 2024. NTK invested in state-of-the-art infrastructure, including an expensive air conditioning system, to meet stringent production standards.

NTK has ambitious expansion plans with significant revenue targets, which were not aligned with its Indian partner. The decision to acquire full ownership of the joint venture was agreed by both parties and the allowed the client to continue growing.

To summarise, the path of the NTK’s business expansion in India has been as follows:

🤝 Partner in India

🏭🔧 Dedicated facility within partner's plant with specialised machinery

🤝➕📈 Joint venture

💼🏭 Acquisition of joint venture and establishment of own production facility

RAW’S INSIGHT ON INDIAN MARKET

Low-Price Strategies

Low-price strategies are paramount for businesses to thrive in the price-sensitive Indian market.

🏷️ Price-Sensitivity: The Indian market is extremely price-sensitive, “companies must evaluate whether they can sell at prices that Indians are willing to pay and may need to adjust their pricing models accordingly” [International Trade Administration]

📉 Dynamic Pricing Strategy: In the cosmetics sector, for instance, reducing the price of well known brand perfume from 2500 INR to 2000 INR could produce a 10X increase in sales. Further reducing it to 1600 INR could amplify sales 100X. This highlights the elasticity of demand in the Indian market and the critical role of competitive pricing.

Local Manufacturing

In India, more than in other regions, the importance of local production is crucial for having a successful business.

Food Sector Challenges:

The importance of Local Manufacturing in India is showcased by the significant difficulties faced by the imported food sector in India. Italian food brands, despite their global fame and prestige, do not perform well in India. This is due to two factors:

🌾 Premature Efforts and Local Preferences: The local culinary culture in India is very predominant, and historically, the Indian people are not accustomed to eating international dishes, let alone cooking them at home. The import of pasta in recent years has not found fertile ground in India, perhaps because it was still too early. However, Indians are traveling more and discovering new cuisines compared to the past. The boom in food delivery has certainly stimulated the entry of international dishes into Indian homes. These factors suggest that in the coming years, there could be a growing demand for products like pasta, which has not yet taken off.

💰 High Prices: Exporting pasta to India means incurring higher costs due to tariffs and transportation expenses. When you add the high costs of marketing campaigns, it becomes clear that the product cannot reach the consumer at a low price. So despite detailed marketing plans, imported pasta did not gain the expected traction due the expensive price, emphasising the need for local production to lower it.

Today, it is better to open a pasta factory than to import pasta due to price considerations - Adriano Ceci Neva

Cost Efficiency Through Local Production:

🚫 Avoiding Extra Costs: Local production helps companies to avoid import duties and high transportation costs, which are significant barriers in the Indian market. By producing locally, they can maintain lower price points, which are essential for capturing a larger market share.

🛍️ Short Supply Chains: Establishing shorter supply chains reduces logistics expenses and improves overall efficiency. This approach ensures that products reach the market faster and at a lower cost, enhancing competitiveness.

Internal Production Success:

🏭 Internal Manufacturing Advantage: Companies that produce internally in India have a distinct advantage due to lower labor costs, despite high overhead expenses.

📜 Licensing for Local Production: Acquiring licenses to produce locally enables to establish a strong market presence. This strategy not only reduces costs but also ensured quicker adaptation to market demands and regulatory requirements.

Rise of Fabless Manufacturing:

📈 Focus on Branding and Marketing:

The fable manufacturing is a business model where companies concentrate on developing a strong brand identity and effective marketing strategies. They invest in market research, advertising, and customer engagement to build a loyal customer base, and they outsource the production to local third-parties.

🏭 Cost Efficiency and 📉 Risk Mitigation

Outsourcing production helps companies avoid high capital expenditures and reduce operational costs, making it economically viable. This strategy mitigates financial risks and provides flexibility to adjust operations as market conditions change.

FINAL TAKES AND CONSIDERATION ON BUSINESS EXPANSION IN INDIA

Despite the obvious growth opportunities and incredible achievements, such as moving from 142nd to 63rd place in the World Bank's Doing Business Ranking in just five years, expanding in India is not all smooth sailing. It's important to keep a few things in mind before making the final decision. For SMEs in particular, partnering with a local entity is almost a mandatory first step, as evidenced by the NTK case.

What should be prioritised most when choosing a partner?

Initial Alignment: 🧩

This is the most crucial part of the selection process of the Indian partner

It is essential to begin with a clear and thorough alignment of goals and expectations. This helps in setting a solid foundation for the partnership.

Mandate and Growth: 📈

Clearly define the mandate and growth plans. Ensure that the partner understands and shares the vision for growth.

Discuss long-term goals and how both parties can contribute to achieving them.

Trust and Communication: 🤝

Building trust is fundamental. Establish open and transparent communication channels from the start.

Significant Investments: 💼

Be prepared for significant investments in the partnership. This includes financial investments as well as time and resources to build a strong and effective collaboration.

Understand that building a successful partnership is a long-term commitment that requires continuous effort and investment.

Closing Thoughts

We hope Adriano's insights and NTK's case study provided valuable lessons on business expansion in India. Do you have additional tips on navigating the Indian market? Share your thoughts and experiences with us!

SOURCES

Markets and Markets Report on Hydraulics Market

This report provides a comprehensive analysis of the global hydraulics market, detailing market size, growth projections, key players, and technological advancements expected to drive market expansion from 2023 to 2028.

OMR Global Report on India Hydraulic Equipment Market

The OMR Global report covers the hydraulic equipment market in India, highlighting market trends, growth drivers, and projections. It focuses on industry challenges and opportunities within the Indian context.

Customer Market Insights Report on India Hydraulic Hose Market

This report by Customer Market Insights examines the Indian hydraulic hose market, projecting significant growth from USD 3.05 billion in 2023 to USD 4.95 billion by 2032. It discusses market dynamics, key drivers, and sector-specific insights.

International Trade Administration on India Market Challenges

The International Trade Administration's guide outlines the challenges and considerations for businesses entering the Indian market. It includes insights into regulatory, economic, and cultural factors that impact market entry and expansion.

World Bank Doing Business Rankings

The World Bank's Doing Business rankings provide an overview of the ease of doing business in various countries. The rankings assess regulatory environments, ease of starting and operating businesses, and overall economic health.

Times of India on Changing Food Palate of Indians

This Times of India article discusses how the food preferences of Indians are evolving, influenced by increased travel and exposure to global cuisines, and the rise of food delivery services bringing international dishes into Indian homes.

LinkedIn Article on Hydraulic Components Market Size

This LinkedIn article provides an overview of the hydraulic components market size in 2023, discussing market trends, growth factors, and industry challenges. It highlights the importance of innovation and investment in the sector.

Mordor Intelligence Report on Hydraulic Equipment Market

The Mordor Intelligence report analyses the hydraulic equipment market, offering insights into market size, key players, growth drivers, and technological advancements. It focuses on the global and regional market landscapes.