01: Exploring Flix's Expansion Strategy in India with Andrea Lovato, Head of Operations India at Flix

Why is Flix expanding to India? What are the challenges? How is Flix operating in India? This and more in today's newsletter

Hi Kula Readers,

Welcome to Kula Connect's first newsletter, it’s a pleasure to have you here!

This is the start of “Let’s Talk” format, in which we interview Indian and European professionals who have bridged the gap between these two worlds.

This week we had the pleasure to speak to Andrea Lovato, Head of Operations for Flix India. During this interview, we were captured by Andrea’s insights on the Indian Bus market peculiarities, the main challenges that Flix is encountering in developing in the Indian Market, and especially why India’s transportation market and the Bus market are so attractive for companies like Flix.

Why we wanted to Interview Flix

In 2018 I (Giuseppe) did my first-ever internship at Flix (back then still called Flixbus)

It was an amazing experience

Great environment, friendly people, lots of learning.

The most exciting part, fueling the growth of such an ambitious startup at the time

Fast forward to 2024, Flix has launched to 43 countries and counting (Including the US and Brazil) and recently in February 2024 to India

Flix is going to connect 46 Indian cities, including Ayodhya, Lucknow, Dehradun, Manali, and Jodhpur, across 59 stops and more than 200 daily connections. In the next stage, the company will look to expand its offering around Delhi and launch its first connections in the South of the country

We decided to reach out to them to see how the company has evolved and how they were planning to expand in the country I love the most, India.

Andrea’s Lovato (Head of Ops India) Interview

Andrea Lovato, after graduating from Bocconi University in Milan, started his professional journey in Thailand, working for Rocket Internet as an International Business Developer. After three years in Thailand in 2015 he came back to Italy to launch the Italian market for Flixbus, at that time a small German startup only present in France and Germany. He took on this challenge and created from scratch the operation processes for long-distance bus routes in Italy and started building up strategic partnerships and expanding the cross-national and domestic FlixBus long-distance bus service network. At the end of 2019, he decided to join De Agostini, an Italian publishing company as Head of Operational development, and in 2021 he transitioned to Gorillas, a grocery quick commerce startup.

In January of 2023, he came back to Flix to embark on a new journey: LAUNCHING FLIX IN INDIA

Why India and Why now?

Andrea called us from Milan where he lives 50% of his time since moving to Delhi at the beginning of 2023. He told us how Flix’s plan to Launch India in 2021 was delayed due to the COVID-19 outbreak, so the project was then revived in 2023. His responsibilities span from hiring the Indian team to scouting for local partners, all to ensure a smooth launch. Flix officially launched in India in February 2024 and has a plan to expand its network by May 2024.

According to Andrea, besides the obvious (India being the second-largest bus market in the world), India was a particularly interesting market for Flix due to three factors

Easiness to obtain transportation authorization

Democratic country with low entry barriers for the transportation market

Fragmented market, resulting from a lack of cooperation among various regional operators, which poses significant challenges for those seeking to operate on a national scale

The Flix, asset-light Model and Why it Can Determine Success in India

FlixBus operates as a long-distance bus service provider, offering affordable and convenient travel options.

Instead of owning the buses, Flix collaborates with local bus companies to carry out the rides, handling commercial management tasks such as route planning, pricing, ticket sales, and marketing. Despite not owning most of the buses, Flix maintains a distinctive brand with buses adorned in their recognizable green color, contributing to a strong brand identity and easy customer recognition.

Originating in 2011, FlixBus emerged in response to the deregulation of intercity travel in 2013, allowing private companies to operate buses and trains.

Flix differentiated itself by adopting an asset-light approach, owning only one bus for licensing reasons and relying on partners for operational execution, similar to the Uber model. Flixbus like Uber doesn’t own any buses allowing them to be very agile and flexible and to open new markets with low investments in Buses.

Flix operates on a revenue-sharing business model, keeping a percentage of the booking price (25-30%) while sharing the rest with its partners. The contracts with partners typically last 3 to 5 years and are subject to renegotiation based on performance.

According to Andrea Flix, easiness of opening in India lies in its asset-light model that allows them to not have to do joint ventures with local companies and be very fast with their operations

How did Flix approach the Launch in India? What is different than other countries?

Andrea told us how much Flix has evolved in the years he left and came back. Unlike in 2015, when Andrea contributed to the launch of Flix in Italy a time when Flix only was present in a few markets and still was a small startup, for the Indian launch the company had become a global corporation, present in +40 markets

Needless to say, everything was different

To ensure a smooth entry into each new market, FlixBus strategically hires individuals on-site and builds a team with knowledge of the local market to conduct thorough research on local companies and establish crucial connections with them. In particular, for the Indian market, Surya Khurana, a seasoned Indian professional who had previous experience at Uber in Amsterdam, has been appointed as Managing director for India

Additionally, FlixBus is focusing on regional operations development, which involves onboarding and training personnel, including a new role—the driver's assistant host, introduced specifically for the Indian market. This role encompasses tasks such as ticket verification, luggage handling, and passenger assistance, ensuring a seamless travel experience.

Moreover, FlixBus is investing in offline infrastructure, with dedicated project manager teams tasked with establishing lounges, ticket sales points, and waiting rooms in each new market.

The first Flix Lounge one: https://maps.app.goo.gl/BgMz5Wr4GGe2UX3P8

Andrea clarified that in India, only public buses have the authorization to utilize public stations for boarding new passengers. Consequently, it becomes imperative to develop private infrastructures, such as lounges or ticket offices, to accommodate travelers and enhance the overall service experience in the country.

Another peculiarity of the Indian Bus market is the driver’s compensation scheme, which is based on a weekly or daily structure, rather than monthly payments like in other markets, which will make cash operations more complex for Flix. This national standard of less structured and more immediate payments forced Flix to adapt its business model to ensure more immediate remunerations to partners and in turn drivers.

Flix positioning in India and marketing strategies

Unlike Europe where Flix is positioned as a low-cost alternative to trains, in India the brand wants to position itself as neither low-cost nor premium, aiming for a reliable and recognized middle-ground position, leveraging the brand awareness and history of the company.

The product is simplified, lacking WIFI and toilets, and is qualitatively less advanced compared to Europe. The buses are similar in type but with a focus on reliability rather than premium features.

Flix has entered the Indian market from the main gate, Delhi, establishing there its headquarters, however, their medium terms plan focuses on extending their reach to other Hubs, like Mumbai and Bangalore, and Tier 2 and Tier 3 cities combining online approaches with offline marketing efforts.

Something that Andrea found Interesting in India is that the majority of buses in the country are sort of “Frankenstein”. In India Automobile body (Bus Body) building is an important activity. The chassis is supplied by Automobile manufacturers, and the body is built by automobile body builders as per the requirements of the customer and specifications of the different State Transport Undertakings.

The current focus is on the standardization of output almost like a franchise, to enhance the safety standards. In the context of minimal oversight by institutions, Flix wants to be best in class when it comes to service standards and safety.

Development in Meta platforms - a future challenge

According to Andrea, the Indian market peculiarity when it comes to ticket purchasing is Meta Platforms. In India, approximately 80% of reservations happen through Metasearch platforms. Right now Flix technical teams are working on making their tickets available to buy on these platforms, for now, they can be bought exclusively on the website due to technical issues with meta-search platforms like MakeMyTrip.

The goal is to be present on these platforms initially and later guide users towards organic channels starting from the second booking due to high fees.

However, something is clear, to win the Indian market, being present in other outlets is FUNDAMENTAL!

To deep dive into this trend of Meta Search Platforms

The Dynamics of Electric Buses in India: Price Structure, Charging Infrastructure, Range, and Fuel Costs

Electric buses are becoming an increasingly prominent player in the world of public transportation, bringing forth challenges and opportunities.

Due to this cost structure, the Indian market is more attractive to switch to EV Buses due to the higher impact of Fuel costs on the total trip costs.

Indeed, according to Andrea, in India, unlike Western markets where approximately 30% of the total cost is attributed to the driver's salary, in India, this figure is significantly lower at 5%.

However, one of the key considerations in the adoption of electric buses is the development of robust charging infrastructure. A well-established network of charging stations is essential to support the widespread deployment of electric buses. Municipalities and transport authorities are actively investing in the creation of charging infrastructure to facilitate seamless operations and reduce concerns related to charging accessibility.

In the following image by Bolt, we can see that the charging infrastructures at present are still too low (1/135 EVS compared to a global ratio of 6/20 EVS) to completely transition to electric transportation and are not evenly distributed in the national territory.

The range or autonomy of electric buses is also a critical factor in determining their effectiveness in meeting the demands of public transportation. According to Andrea the EV buses are still not very reliable and don’t have enough range to compete with combustion engine solutions.

Flix's strategy in the coming years is to first develop a strong network of traditional combustion engine buses and then start to think of switching to electric or hydrogen.

Flix Future Plan in India

The company has set an ambitious goal to establish itself as the primary market leader within the next 7-8 years also considering the seasonality, which differs from Europe meaning that it can help the company balance the global cash flow

INDUSTRY REPORT 🚎

The Indian Transportation Market

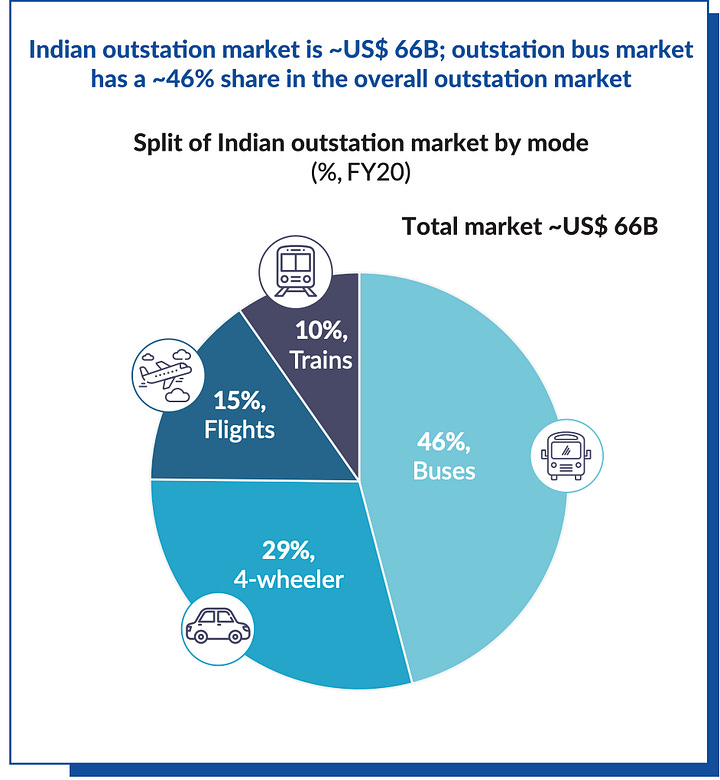

With an estimated market size of €30bn*, India is the second-largest bus market in the world

The bus market in India is highly diverse, encompassing various segments such as public transport, inter-city travel, and tourism.

The market exhibits a blend of traditional internal combustion engine buses and a growing emphasis on electric and alternative fuel-powered buses.

1lattice estimates that the India Bus Market size will experience a growth rate of approximately 9.8% during the forecast period of 2020-25, as shown in the graph below

Buses play a crucial role in providing affordable mass transit solutions and alleviating congestion on road networks. Government policies promoting public transport and reducing carbon emissions have led to increased investments in public bus transportation systems, driven by initiatives like smart cities and clean energy adoption.

Several factors drive the growth of the Indian bus market, including:

Urbanization

population increase

Increase in people's disposable income

Government efforts to enhance public transportation

Digitalization of the economy and subsequent shift to online media outlets for ticket purchase

The rising demand for electric and hydrogen-powered buses and the push for cleaner and greener transportation, along with technological advancements like smart features in buses, also contribute to market growth.

Market Challenges:

Despite growth opportunities, the Indian bus market faces challenges, including:

infrastructure constraints such as inadequate road networks and maintenance

hindering optimal bus operations

Economic factors, regulatory challenges, and high initial costs, particularly for adopting new technologies like electric buses

competition from alternative modes of transportation.

COVID-19 Impact:

The COVID-19 pandemic had a significant impact on the Indian bus market, causing a sharp decline in demand for bus services. As we are going to see later on Flix's original launch in India was planned in 2021 and was delayed to 2024 because of the Covid-19 outbreak. Disruptions in the supply chain and manufacturing processes further compounded the challenges.

Government initiatives

Anticipated to expand further, the Indian bus market's growth is also attributed to increased government spending on public transport infrastructure development and investments by cities across the country to enhance urban mobility services, including buses and other mass transit systems like metro rail networks.

According to the Ministry of Housing and Urban Affairs’s benchmark cities need 60 Busses per one lack of population. Taking a city like Delhi which has an urban population of 20.57milion people, at least 15.000 buses must be used, however, at present only 7000 buses are available, showing a need for investments in this sector by both the government and private companies like Flix

India's federal government has approved a 580 billion rupee ($7 billion) initiative to introduce 10,000 electric buses in 169 cities over the next decade. The project includes the development of charging infrastructure. The federal government will allocate 200 billion rupees through a public-private partnership.

The Government of India is actively promoting electric mobility and charging infrastructure. With 5254 operational Public Charging Stations (PCS), initiatives include removing the need for a license to charge at stations, amendments to technical standards by the Central Electricity Authority, and revised guidelines from the Ministry of Power. The Bureau of Energy Efficiency (BEE) leads efforts, and a "Go Electric" Campaign has been launched for public awareness. Action plans for nine cities aim for 46,397 PCS by 2030. Ministries are encouraged to transition official vehicle fleets to electric, and urban development guidelines have been amended.

One pivotal effort is the FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme, aimed at boosting the adoption of electric and hybrid buses through subsidies and incentives. This initiative tackles air quality issues and aligns with global emissions reduction goals.

Furthermore, several states and cities are implementing Bus Rapid Transit (BRT) systems, prioritizing dedicated lanes, intelligent traffic management, and modern bus stations.

Conclusions

In conclusion, FlixBus's journey from its inception in 2011 to becoming Europe's market leader in long-distance travel is a testament to its innovative, asset-light approach and emphasis on digital solutions. The acquisition of competitors, expansion into new services like FlixTrain, and a global presence showcase the company's resilience and adaptability.

As FlixBus ventures into the Indian market, several takeaways emerge.

The success of FlixBus in Europe is rooted in its strategic collaborations with local partners, a model that can be tailored to suit the diverse landscape of India. The emphasis on digital platforms and dynamic pricing, coupled with the flexibility to operate with a combination of electric and traditional buses, positions FlixBus well for the evolving Indian market.

The story of FlixBus serves as an inspiration for mobility providers globally, emphasizing the significance of leveraging technology, forging strategic partnerships, hiring great people, and staying attuned to the unique needs of each market.

What do you expect to be the biggest challenge for Flixbus in India in the upcoming months? Let us know in the comments!

Well structured post with all the relevant details! Very insightful! ✨

Very insightful