13: Navigating Venture Capital and PropTech in Europe and India with Aditya Srivastava

VC landscapes, nuances of the Proptech industry, and highlights on the importance of market expansion in India and Europe

📝 Words: 1,723 | 🕰️ Estimated Reading time: about 7 mins

Hey Kula readers 👋

Today, we're excited to delve into the dynamic worlds of Venture Capital and PropTech across Europe and India, guided by the expertise of Aditya Srivastav, ESCP Alumni, who has experience in the VC and startup ecosystems of both regions.

In this exploration, we'll uncover similarities and distinctions within the VC landscapes of these regions, examine the nuances of the Proptech industry, and highlight the importance of market expansion for Indian startups, especially their focus on targeting the profitable US market.

Key Takeaways

🎯 Market Focus and Business Models: Aditya highlights the similarities in processes between European and Indian VC funds but emphasizes the significant differences in market focus and business models. While processes remain consistent, market needs, regulatory environments, and consumer behaviors vary significantly between the two regions.

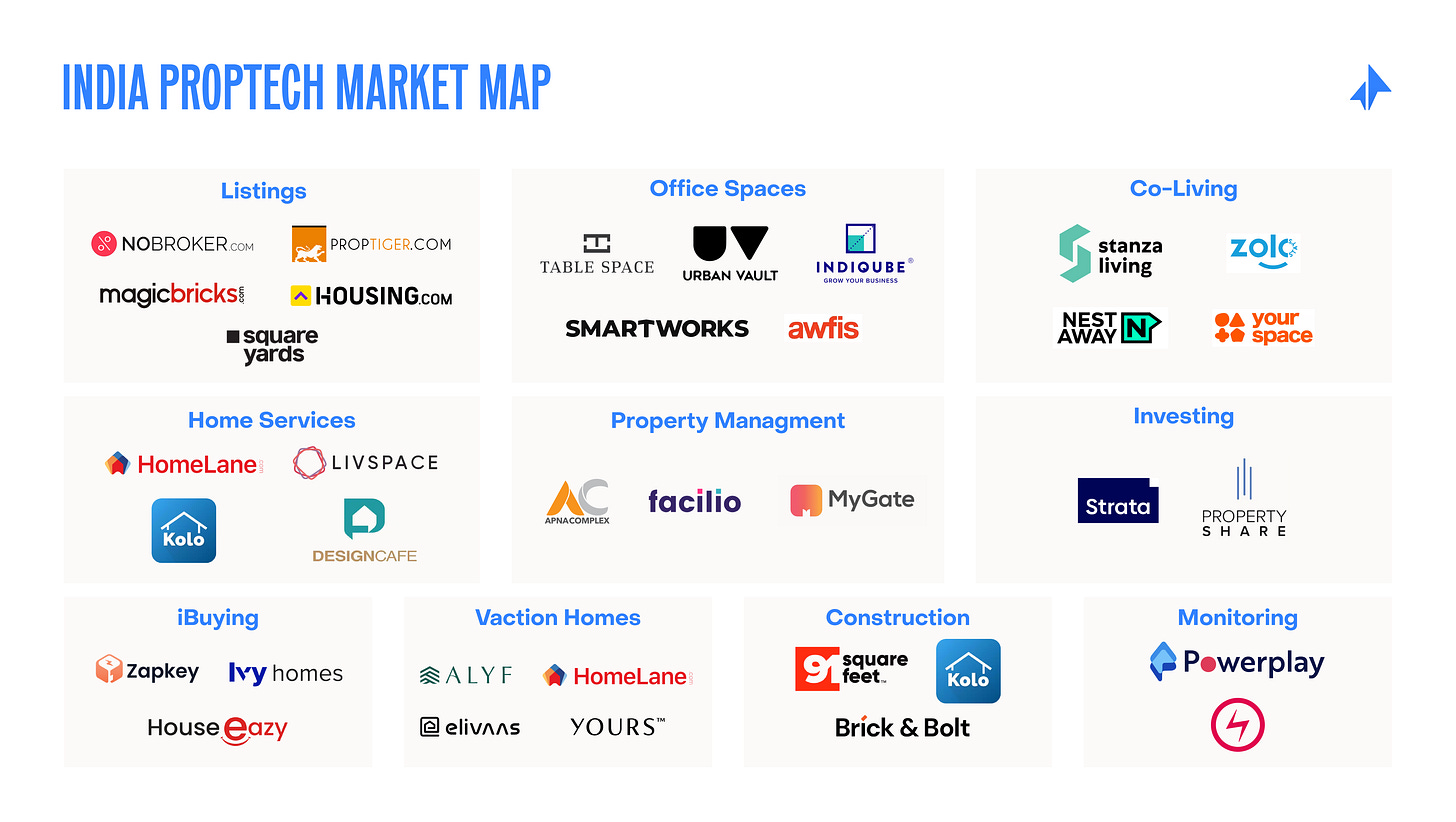

🚀 PropTech Diverse Ecosystem: The global PropTech market is set to grow from $36.55 billion in 2024 to $89.93 billion by 2032 (Top markets are USA, Spain, UK and India). Europe is advancing in energy-efficient technologies, like heat pumps and smart grids, driven by climate goals. India, with its rapid urbanization, is innovating in mobile-first property solutions and IoT integrations to optimize building management.

🗺️ Global Expansion Strategies: Indian startups needs to go global to monetize. They are targeting North America for its vast market, funding availability, and language advantages. With competitive software offerings and strategic go-to-market plans, these startups are successfully entering the US market. How can Europe get more attractive

This article is not associated to Kalaari Capital

Aditya Background

Aditya Srivastava is an analyst at Kalaari Capital, an early-stage, sector-agnostic venture capital fund in Bangalore, India, where he focuses on healthtech and proptech.

He studied at ESCP in Paris and Berlin, where he refined his skills in financial analysis and international business.

During his studies, Aditya gained experience in the investment and startup world, working at UniCredit and then spending two years in strategy and founder office roles, supporting CEOs and CFOs through various stages of growth. Driven by a desire to support more founders, he went on to work as a venture developer at The Next Big Thing, a venture studio, and as an investment analyst at PT1, an early-stage VC specializing in real estate technologies.

After exploring the European market, Aditya decided to move back to India to make an impact in his home market and witness firsthand its rapid evolution by working at Kalaari Capital.

Working for a VC Fund in India: Similar Processes, Different Market Needs

Working for a VC fund in India is similar to working for one in Europe in terms of processes but differs significantly in market focus and business models, Aditya comments.

The approach to deals is consistent, with investment scouting, founder interactions, and due diligence processes being fairly similar across geographies.

"If the deal is competitive, thorough and in-depth founder conversations and deal preparation is required no matter your location." - Aditya Srivastava

As in Europe, VC funds in India leverage their internal networks to find new investment opportunities or have founders approach them directly.

The typical founder profile is also fairly aligned, with many coming from prestigious institutions (such as IITs and IIMs in India, and leading Business and Engineering universities in Europe), top firms (including MBB consulting firms, major tech companies, and investment banks), or successful startups, and primarily being based in the biggest cities.

In recent years, this has evolved in India, with many founders now emerging beyond traditional targets—extending beyond tier-one cities and including those with diverse backgrounds. More and more founders are former employees of successful startups.

"In the US, there is the PayPal Mafia; in India, there is the Flipkart Mafia." - Aditya Srivastava

So what is different?

While processes are simialr, key differences between the European and Indian ecosystems include:

📍 Different market needs: The distinct demands of each market drive unique business models and focus areas. In India, there is a higher emphasis on affordability and accessibility, whereas Europe prioritizes sustainability and advanced digital solutions.

👩⚖ Regulatory and market tailwinds: These vary significantly across geographies and impact the adoption and growth of PropTech solutions. Europe's mature regulatory frameworks provide stability, while India's evolving regulations present both challenges and opportunities.

💵 Financial prudence: Indian consumers are much more price-sensitive and less willing to pay a premium for advanced features than Europeans.

🌎 Go-to-market strategies: In India, it is easier to achieve rapid user growth, but much more challenging to attain a satisfying ARPU (Average Revenue Per User). In Europe, the situation is the opposite. Therefore, Indian start-ups need to plan their international expansion strategy early on to optimize financial performance, while European start-ups need to expand outside their local market to continue growing their customer base.

Bridging Tech Evolution: Contrasting Perspectives in Proptech from Europe to India

When examining PropTech, there are some differences between the Indian and the European markets.

Proptech, or property technology, is this intersection of the real estate industry with technology, software, and digital solutions aimed at maximising the sale-purchase, research, marketing, and management of properties.

🔎 The market

The global PropTech market size is projected to grow from $36.55 billion in 2024 to $89.93 billion by 2032, at a CAGR of 11.9% during the forecast period.

In 2021, India is the highest-ranked country outside of North America and Europe in the PropTech sector, following USA, Spain and the UK.

The European PropTech market registered a record year, reaching approximately 20% of global investment, including over 200 venture capital investments totaling €3.8 billion.

As of June 2022, the Indian PropTech industry has received an overall private funding of $3.42 billion since 2009.

🔎 Key Trends

PropTech relevance varies significantly between Europe and India due to differences in market maturity, regulatory environments, consumer behavior, and investment climates.

In Europe, the mature and well-regulated real estate markets, combined with advanced digital infrastructure, support the adoption of sophisticated PropTech solutions. European consumers, who are generally tech-savvy and demand sustainable solutions, benefit from a supportive regulatory framework, including stringent data privacy laws like GDPR. The robust venture capital environment and various government initiatives further bolster PropTech growth.

Aditya noted that in Europe, the prevailing focus within PropTech and construction tech revolves around energy and climate tech investments. This encompasses ventures in battery tech and recycling, alongside retrofitting and renovation initiatives driven by escalating oil prices. Renewable options, like heat pumps, gain traction for their sustainability. Investments cascade along this value chain, with notable players emerging, such as OneCommaFive and Otak, the latter addressing workforce skill gaps and providing an operating system for heat pump integrators.

In contrast, India’s rapidly growing yet fragmented real estate market, characterized by evolving regulations and some bureaucratic challenges, presents a different landscape. Indian consumers, with their diverse behaviors, high price sensitivity and high mobile penetration, favor mobile-first and affordable PropTech solutions. The country is experiencing increasing investments from both domestic and international sources, driven by initiatives such as the Smart Cities Mission.

Aditya notices that emerging areas encompass access management, building facilities management, and building information modeling. The challenge lies in digitizing the building stock through IoT sensors and SaaS models to optimize facilities.

In India, as internet penetration and digitisation become ubiquitous in emerging (Tier-II and Tier-III) cities, Proptech and these sub-sectors show immense potential in unlocking real estate potential in rural and urban areas and driving holistic localised growth.

99acres, Magicbricks, and Nobroker are a few of the most prominent names in this industry where buyers, sellers, and agents can collaborate and exchange information about real estate with the touch of a button.

Strategic Expansion: Navigating Global Markets

The Indian market offers immense potential for scaling user bases and testing technology at large scales. However, monetization poses challenges and often needs to be seeked elsewhere.

"Start-ups need to optimize their go-to-market for global expansion." - Aditya

While Proptech solutions may cater to local nuances, especially in India and other Southeast Asian markets, start-ups with SaaS models boast broader use cases relevant globally. These ventures typically employ a focused global go-to-market (GTM) strategy, primarily targeting expansion into North America.

The US serves as a direct expansion point for companies for three main reasons:

🇺🇸 The market size offers substantial opportunities for better financial performance.

💸 Funding availability is significant, with most venture capital funds capable of supporting Series A and beyond being located there.

🗣 Language poses no barrier to entry, facilitating smooth operations and communication.

According to the Indus Valley Report, the majority of SaaS companies in India sell globally, primarily to North America. Consequently, most revenue for Indian SaaS start-ups originates from across the globe, while their cost centers remain in India.

European markets are considered more difficult to crack because of the language barriers, more fragmented regulations and different customers needs.

Cracking the US Market: Strategies of Indian Start-ups

Indian start-ups are making significant strides in the competitive US market by leveraging key strategies.

Firstly, they offer exceptional software, on par with or surpassing offerings from American counterparts, but at more competitive price points. Additionally, the resource constraints faced by Indian companies compel them to adopt a more focused go-to-market (GTM) approach compared to their American counterparts. This entails defining a narrow Ideal Customer Profile (ICP) and building a localized sales team.

In recent years, India has witnessed the emergence of market leaders across various sectors. For instance, in private market intelligence, platforms like Specter have gained prominence, providing robust solutions for private market analysis. Synaptic, another notable platform originating from India, is globally utilized by venture capital firms, including those in Europe. Additionally, companies like Zluri have excelled in SaaS optimization software, particularly within the US market.

These success stories underscore the competitiveness and innovation prowess of Indian start-ups, solidifying their position as formidable contenders in the global arena.

Join the conversation!

We hope you found this article thought-provoking and informative on the VC, startup, and Proptech landscapes in India and Europe.

Do you know any Proptech companies that have successfully expanded into India or Europe? How can we attract more Indian start-ups to Europe? How can they be more attracted to collaborate with the European start-ups?

🗣 Join the conversation and share your insights!

Really insightful! Especially the differences in consumer preferences between India and EU.